A wide network of companies, ranging from second-level banks to aggressive microcredit institutions and debt-collection firms, operates under a single controlling hand. The owners of ABI Bank oversee an expanding ecosystem of businesses created to blur the trail of where Albanian citizens’ money ultimately ends up.

The same individuals who control collateral-based lending to individuals and businesses also run microcredit operations known for extremely high interest rates. But their most profitable tool is the debt-collection industry, since they also manage a licensed financial institution operating in this field.

Large sums of money are suspected to be transferred abroad, into offshore jurisdictions where ownership is obscured and accountability is nearly impossible.

These same individuals have also expanded into real estate and construction projects in Tirana and along the Albanian coastline, forming what appears to be a coordinated chain used for money laundering.

The case is significant enough to warrant the attention of the Special Anti-Corruption Prosecution, given the widespread suspicion of illicit financial activity.

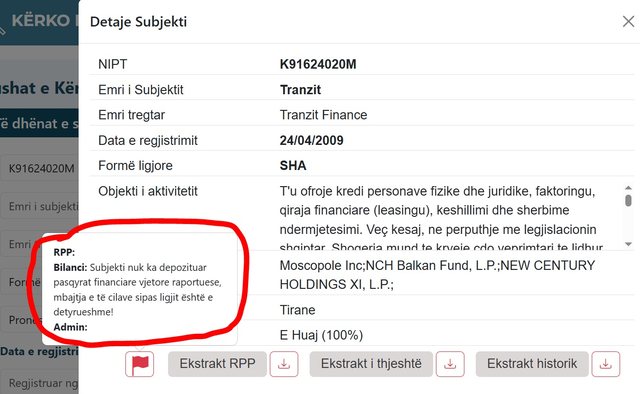

At the center of this structure stands Andi Ballta, who oversees the entire network through the holding company Tranzit.

Originally established to collect non-performing loans, Tranzit now owns ABI Bank, NBG Bank, and the financial institution NOA, purchased in early 2025.

Tranzit is also the owner of Moscopole, which in turn holds the company MA1, as well as the newly created construction firm Bay View Alternative Investment. This last company is set to develop a massive 32-hectare property in Poro, Vlora, land that was previously left as collateral with ABI Bank.

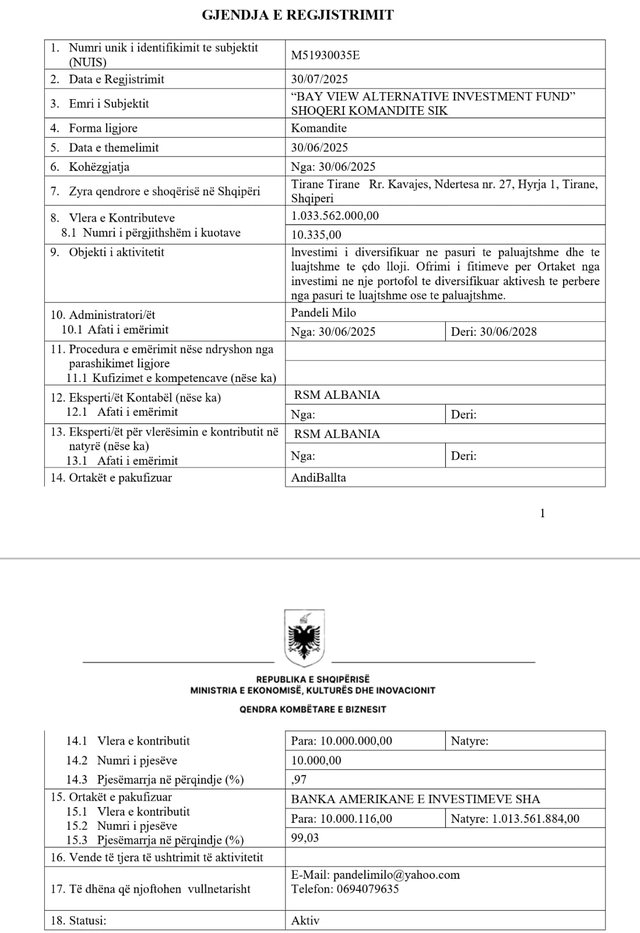

Bay View Alternative Investment: A 32-Hectare Coastal Megaproject Linked to ABI Bank

Bay View Alternative Investment was created in July 2025 by the American Bank of Investments, which owns roughly 99 percent of the shares. Less than 1 percent is held personally by Andi Ballta, who effectively controls the company, given that ABI Bank is owned by Tranzit — and Tranzit itself is majority-owned by Ballta.

The most concerning issue is that funds from banks and microcredit institutions appear to be reinvested into this enormous coastal property, raising questions about compliance, transparency and the source of the capital used.

How was the land placed as collateral? Who were the original debtors? Was the property properly processed through an auction, as required by Bank of Albania regulations? These are major red flags for regulators.

Debt Collection Profits and Missing Financial Reports

At the top of the structure sits Tranzit, once a typical debt-collection firm — similar to Micro Credit Albania, ADCA and FINAL. Yet unlike these companies, which have been shut down and are under criminal investigation, Tranzit has remained outside prosecutorial scrutiny.

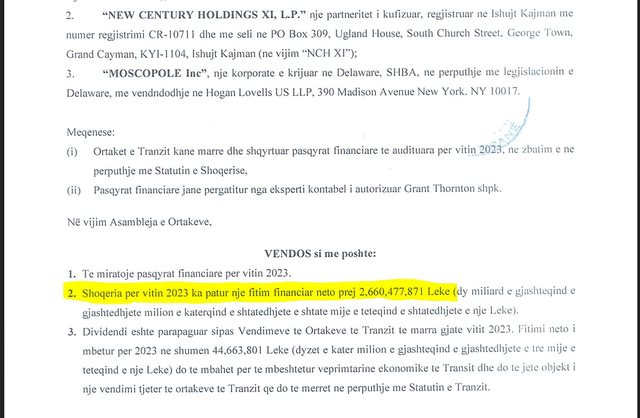

Documents obtained by VoxNews reveal that in 2023, during the peak of Albania’s debt-collection scandal, Tranzit declared an astonishing profit of 26 million euros. However, in 2025 the company refused to publish its 2024 financial report, in violation of the law — an action widely interpreted as an attempt to conceal sensitive financial data from authorities.

The microcredit scandal has only strengthened Tranzit’s dominance in this highly controversial market. Through the strategic maneuvers of Andi Ballta, Tranzit has become the parent company of several entities — including ABI Bankitself.

Suspicious ABI Bank’s Expansion: From NOA to NRG Bank

The chain of companies tied to ABI Bank continues to grow. According to documents reviewed by VoxNews, ABI Bank has extended its reach into licensed financial institutions regulated by the Bank of Albania, including microcredit lenders such as NOA.

In January 2025, ABI Bank purchased NOA through a suspicious offshore-based transaction executed in Delaware, a jurisdiction known internationally as a tax haven. Following the acquisition, NOA was absorbed into ABI Bank and now operates as part of its structure.

Years earlier, ABI Bank, led by Andi Ballta, also purchased NRG Bank, formerly the Greek bank operating in Albania, for approximately 70 million euros.

Political Shielding and Lack of Oversight

The dominance of ABI Bank appears to be supported by political connections. Members of the bank’s supervisory board have included Lindita Rama, the spouse of Prime Minister Edi Rama. Meanwhile, former opposition figure Elvana Hana has also held leadership roles within the bank.

This suggests that ABI Bank may enjoy strong protection across both government and opposition circles. Despite its questionable operations, it has faced no meaningful administrative audits or criminal investigations.

As ABI Bank continues expanding its network, now moving aggressively into construction and real estate — the concentration of financial power in the hands of Andi Ballta raises urgent concerns over money laundering, consumer exploitation and regulatory failure in Albania. /voxnews